When land is developed or its use is changed especially in urban and peri-urban areas its value tends to increase significantly due to public infrastructure improvements or changes in zoning. To ensure that governments and communities benefit from this rise in property value, a land betterment charge is often applied. This charge serves as a financial tool used to recover part of the increased land value resulting from public investments. One key element of this mechanism is the Land Betterment Charge Table of Rates, which determines how much landowners must pay based on the degree and nature of improvement or development.

Understanding Land Betterment Charges

What Is a Land Betterment Charge?

A land betterment charge is a fee imposed by local or national governments on landowners who benefit from changes in land use regulations or from infrastructure developments. This could include new roads, public transportation systems, or changes that allow higher density construction. The idea is that landowners should share a portion of their unearned profit with the public that funded or facilitated the improvement.

The Role of the Table of Rates

The Table of Rates is a standardized chart or matrix that outlines the specific fees or percentages applicable to different categories of land development or betterment. It ensures transparency, consistency, and fairness in the way charges are calculated and collected. The table is usually updated periodically to reflect changes in market value and development patterns.

Key Components of the Table of Rates

Location-Based Charges

One of the main factors influencing the land betterment charge is the location of the property. Urban areas typically have higher rates due to their proximity to amenities and infrastructure. In contrast, rural or underdeveloped areas may have lower charges to encourage development.

- Central Business District (CBD): Highest rate due to premium value and access.

- Suburban Areas: Moderate rate depending on infrastructure and population density.

- Rural Land: Lowest rate to promote growth and reduce migration pressures.

Land Use Change Category

Different types of land use changes trigger varying rates in the table. For example, converting agricultural land into residential or commercial land typically incurs a higher charge compared to changing from low-density residential to medium-density residential.

- Agricultural to Residential: Higher charge due to dramatic increase in land value.

- Industrial to Commercial: Moderate charge, especially if the area becomes more marketable.

- Residential to Mixed-Use: May have lower charges if aligned with smart city plans.

Size and Zoning Classification

The size of the land and its zoning classification also influence the charge. Larger plots or those zoned for high-rise buildings usually face steeper charges due to their increased development potential.

Purpose of Implementing a Table of Rates

Standardization and Fairness

By providing a clear and uniform method for calculating land betterment charges, the table prevents arbitrary or inconsistent assessments. It ensures that similar types of developments in similar locations incur similar charges, promoting equity among landowners.

Revenue Generation for Public Projects

The revenue collected through land betterment charges can be reinvested into infrastructure, transportation, sanitation, and social programs. This creates a sustainable development cycle where private gains contribute to public benefits.

Controlling Speculative Development

Charging for land value increases discourages speculative land hoarding and promotes productive land use. Developers are incentivized to utilize land efficiently rather than holding it unused while waiting for value to rise.

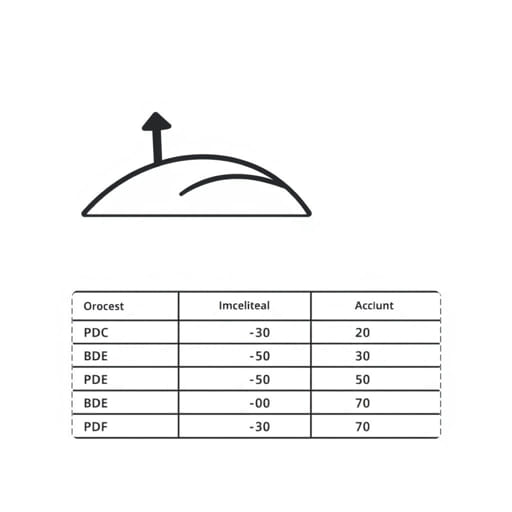

Sample Table of Rates (Illustrative Only)

| Zone Classification | Land Use Change | Rate per Square Meter | Rate as % of Land Value Increase |

|---|---|---|---|

| Urban Commercial | Residential to Mixed-Use | $100 | 20% |

| Suburban Residential | Agricultural to Residential | $60 | 15% |

| Rural | Agricultural to Light Industrial | $30 | 10% |

| Urban CBD | Low-Rise to High-Rise Development | $150 | 25% |

Note: Actual rates depend on local laws, appraisal methods, and economic conditions.

Factors Affecting Rate Calculations

Market Value Appraisal

The increase in property value is typically assessed by certified property appraisers. The appraisal determines how much value the land has gained due to changes or public investments.

Time of Application

Rates may vary depending on when a development application is submitted. Some jurisdictions offer grace periods or discounts for early development to stimulate growth.

Infrastructure Availability

If the development is in an area where the government has recently installed infrastructure like roads, electricity, or water systems, the charge will likely be higher, reflecting the benefit derived from public spending.

Exemptions and Concessions

Public Purpose Projects

Lands developed for schools, hospitals, or non-profit housing projects are often exempt from land betterment charges to encourage essential services in communities.

Affordable Housing Incentives

Developers building affordable or low-income housing may receive concessions or lower rates to support social equity in housing.

Historical or Cultural Zones

Properties located in protected heritage or cultural zones might receive exemptions to maintain preservation efforts and avoid over-commercialization.

Legal and Administrative Framework

Governing Authority

Land betterment charges are administered by urban planning departments or land management authorities. They publish official rate tables and handle payment processing and disputes.

Dispute Resolution

Landowners who disagree with the assessed charge can usually file an appeal. This process often involves re-evaluation by an independent appraiser or administrative tribunal.

The Land Betterment Charge Table of Rates plays a vital role in managing land development and urban growth. It ensures that landowners who benefit from regulatory or infrastructural changes contribute to the public purse. By incorporating location, zoning, and land use into a fair and structured table, governments can support equitable development, discourage speculation, and finance public services. Understanding how the table of rates is formulated and applied helps developers, property owners, and planners navigate the landscape of land transformation more effectively.